Flippa Review: Best Place to Buy a Small Website?

When you buy something through one of the links on our site, we may earn an affiliate commission.

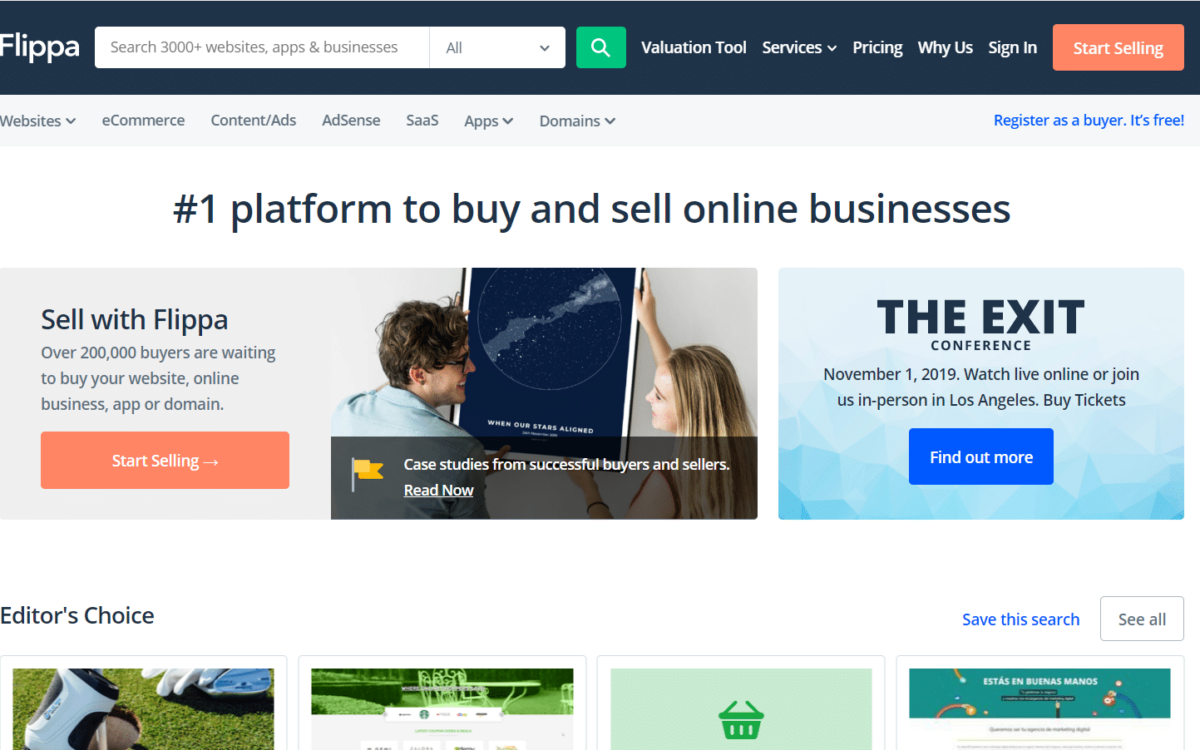

Flippa got its reputation as the place to go if you're looking to buy or sell online businesses without remortgaging your house, or if you aren't into a valuation with at least four zeros. Is this still the case? We'll dive into this with our in-depth Flippa review.

Flippa allows you to buy and sell web properties. In this Flippa review, we'll take a look at buying and selling on Flippa. We'll judge whether Flippa is a viable marketplace (it is), how prevalent scams are (pretty common), and how to buy or sell a real and valuable web property.

Flippa Review

-

Ease of Use - 100

-

Viability For Sellers - 90

-

Viability For Buyers - 5

-

Price - 95

Summary

Flippa is a lower end marketplace for online business owners. It's a pretty good place to sell your site if you don't mind dealing with a lot of tire kickers. I can't recommend that anyone buy a site on Flippa though. There are just too many scams out there.

Pros

- Can buy and sell businesses in any price range

- Very easy to navigate

Cons

- More scams than a 3 AM infomercial

Contents

Flippa Pros

Flippa is used by literally millions of buyers and sellers to purchase or shift online businesses. Here are a few things it gets right:

Can Buy Or Sell At Any Price Range

Flippa fills a market need by allowing owners of small to medium-sized businesses buy and sell on their platform. As much as I love Empire Flippers, FEInternational, and Quiet Light Brokerage, you aren't getting any time of day on those platforms unless you're well into the five figures valuation.

Flippa allows anyone to list any site for sale. As a result, you can buy any site for sale.

I appreciate how there's room for anyone to use Flippa. Whatever your budget, whatever your asset size. You can buy or sell online businesses on Flippa.

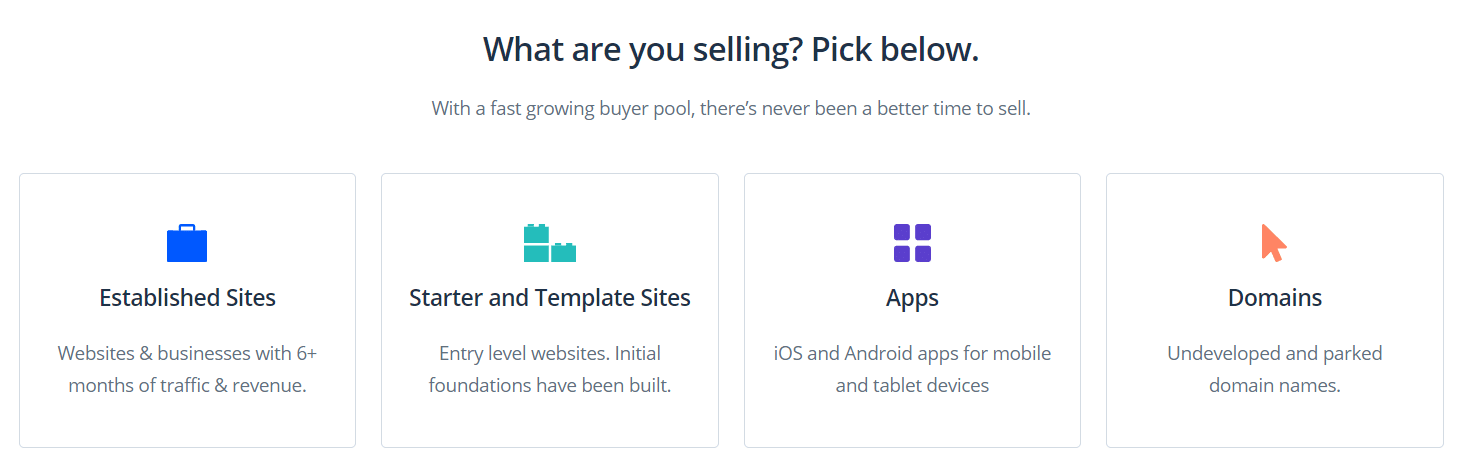

A corollary to this is that you can sell almost anything on Flippa. The platform allows you to sell websites, domain names, apps, FBA online businesses, SaaS, and more.

Another thing I like about Flippa is that it is super easy to get around.

On the seller side, it doesn't take more than 5-10 minutes to list a site for sale. For buyers, there are an enormous number of filtering options.

I think the home page is intuitive and helps you get to where you're going.

Flippa gets top scores for ease of use, filtering through live listings, and navigation.

Great Sites at a Low Multiple

Another “pro” of Flippa is that there are actually some good deals to be found there, you just have to do some digging. As I'll share in the “cons” section, you definitely have to sift through a lot of sites before you will find the diamonds in the rough…but people do sell websites worth buying on Flippa. You just have to find them.

Flippa Cons

Flippa is cool, but it's not perfect. To be honest, the platform has a long way to go before it gets to perfect.

Potential Problems and Scams

Are you the kind of person who gets excited when you see an email from a Nigerian prince? Then Flippa could be the place for you. Buy to your heart's content.

Overall, be warned: Flippa has a history of scammy live listings.

Unfortunately, there are lots of ways you can get scammed online and Flippa is a hot spot for scammers.

Many of these problems could be solved if Flippa did better due diligence when it comes to verifying the online businesses for sale.

In some cases, traffic and earnings are automatically verified (program-attic connections), but in other cases, it is purely based on the word of the seller before it goes up on the listing page.

Sellers can get pretty creative when it comes to scams on Flippa.

Mushfiq from TheWebsiteFlip has done 110 deals since 2010 on Flippa and wrote a helpful blog post outlining ten of the most common red flags to look out for when buying on Flippa.

Sites that sell for really low multiples compared to their monthly “profit” are everywhere on Flippa. And just because you see bidders doesn't mean that it's a legitimate, valuable web property.

This is the problem that Spencer is trying to fix with Motion Invest. They verify every website so that you can be sure you are buying a site with verified earnings.

I'll talk about some ways to avoid scams on Flippa a little later on.

Flippa Review

For the most part, Flippa is either well received or very poorly received on the internet.

Reviews on Trustpilot put Flippa at a solid 4/5 stars. People say things like “I'm very pleased with the service…” or “Highly positive review…” or “Loved my experience with Flippa…”

But then you go to reviews on SiteJabber and the average consensus puts Flippa at about a 1.3/5. Among insults regarding customer service agents' mothers, you can imagine the other things that are said here.

So which one is true? Is Flippa a 4/5 or a 1.3/5?

There are two parts to Flippa that we're going to look at: buying and selling. Let's start by looking at selling online businesses on Flippa.

Flippa Review: Selling On Flippa

Flippa is a marketplace for four types of web properties: starter sites, established sites, apps, and domain names. You can sell any of these on Flippa and the process is pretty similar for all of them.

(We'll talk about why Flippa distinguishes between starter and established sites in the Buying on Flippa section, so keep reading).

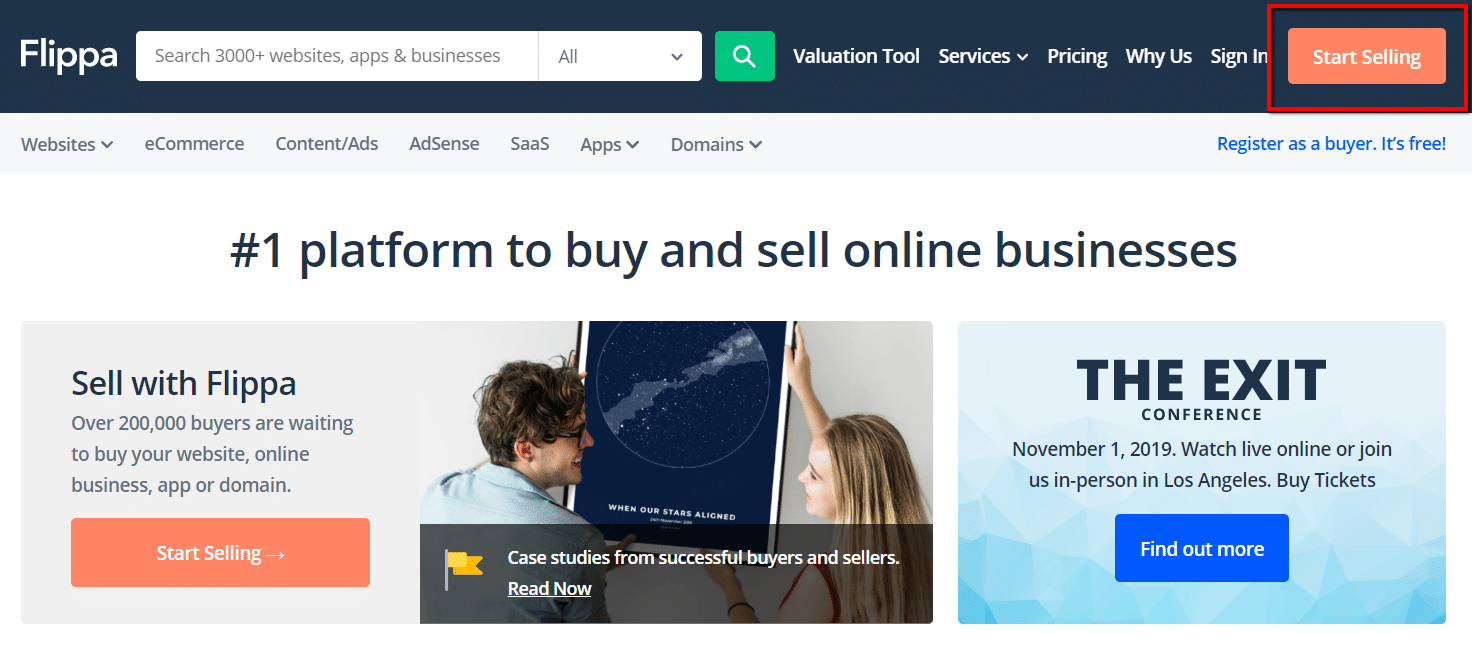

It's easy to get started selling on Flippa. On the home page, you'll see a big button that says “Start Selling”:

When you click the button, Flippa will ask you what kind of web property you're thinking about selling. This is where you'll distinguish between established sites, starter sites, apps, and domain names.

I chose “Established Sites” for our example.

Flippa will then lead you through creating your listing. They will ask you several basic, starter questions about your business:

What's the business name?

Where is it based?

What industry is it in?

And so on. Then you get into the more advanced questions.

If you know much about buying or selling web properties, you'll be pretty prepared. Explain your income sources, talk about how you make money, possible weaknesses, opportunities for the new owner, staff size, and so on.

It's pretty basic stuff, but do be prepared to spend time on this. Everything you put here will help potential buyers and allow you to sell your business faster for a higher profit.

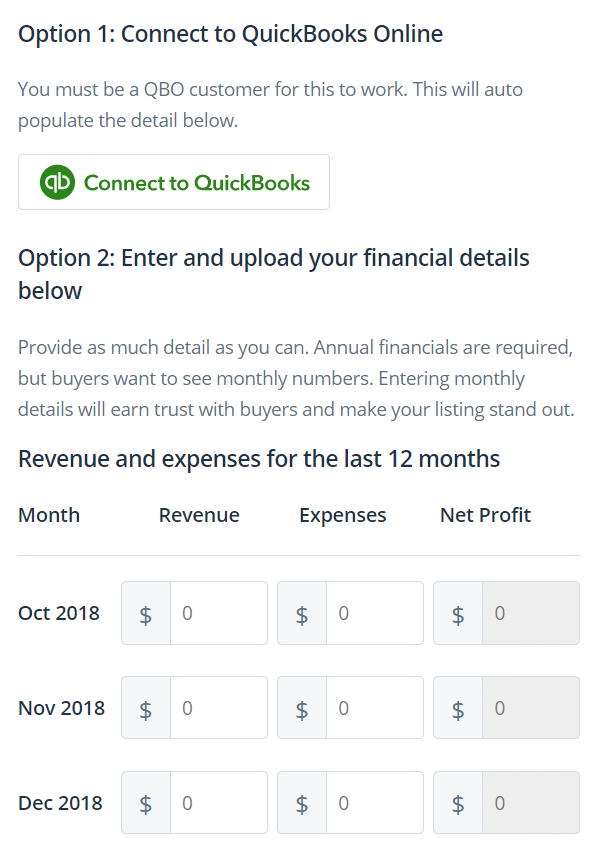

Then you get into the nitty gritty. Flippa doesn't vet any of their business listings, but they do require that you provide “documentation”.

I put that word in quotes because your documentation can be just about anything.

And I do mean anything.

There are 2 ways to verify your income: You can connect Flippa to QuickBooks or you can fill out the info yourself. No fact checking, no verification required.

*facepalm*

So I said that my website had been earning $10,000 per month with $100 expenses for a total net profit of $9,900 per month since last year.

Flippa does require that you upload a Profit and Loss (P&L) statement. But again, this can be anything. I just uploaded the last screenshot that I took. You can upload a picture of a purple squirrel or a doctored P&L that, like any good Instagram model, has been touched by a fair amount of Photoshop.

Do know that buyers can see this P&L, so you couldn't sell a site that offers just uploaded pictures of purple squirrels as a P&L. But if you're a buyer, understand that there is no verification process that goes into this.

After adding your revenue, Flippa asks that you connect Google Analytics. (This is a good way to verify traffic, so I think Flippa has done that well).

Then you list the business assets. This includes social media accounts, hosting, email accounts, and whatever else is included in the business. Your physical inventory would go here.

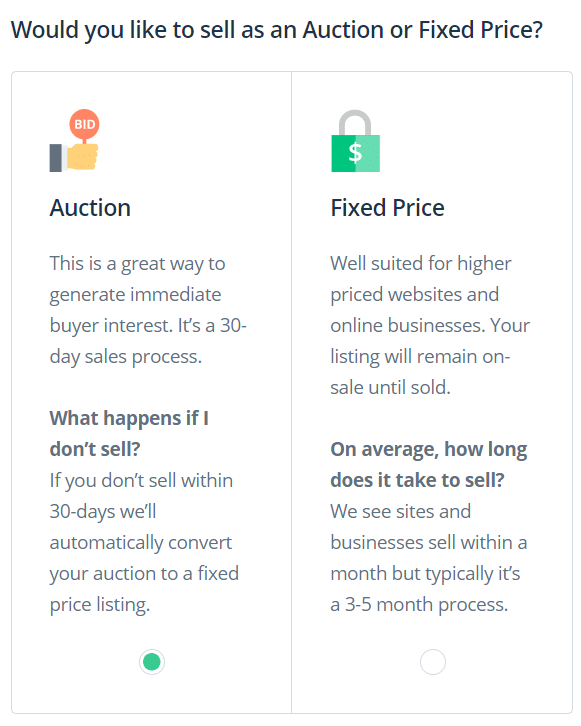

And then we're at the last step where we select our selling details. Flippa recommends a sale price and allows you to choose to sell through an auction or through a fixed price listing.

The fixed-price listing in general is for higher-priced businesses.

Now it's time to select how we want the site to sell.

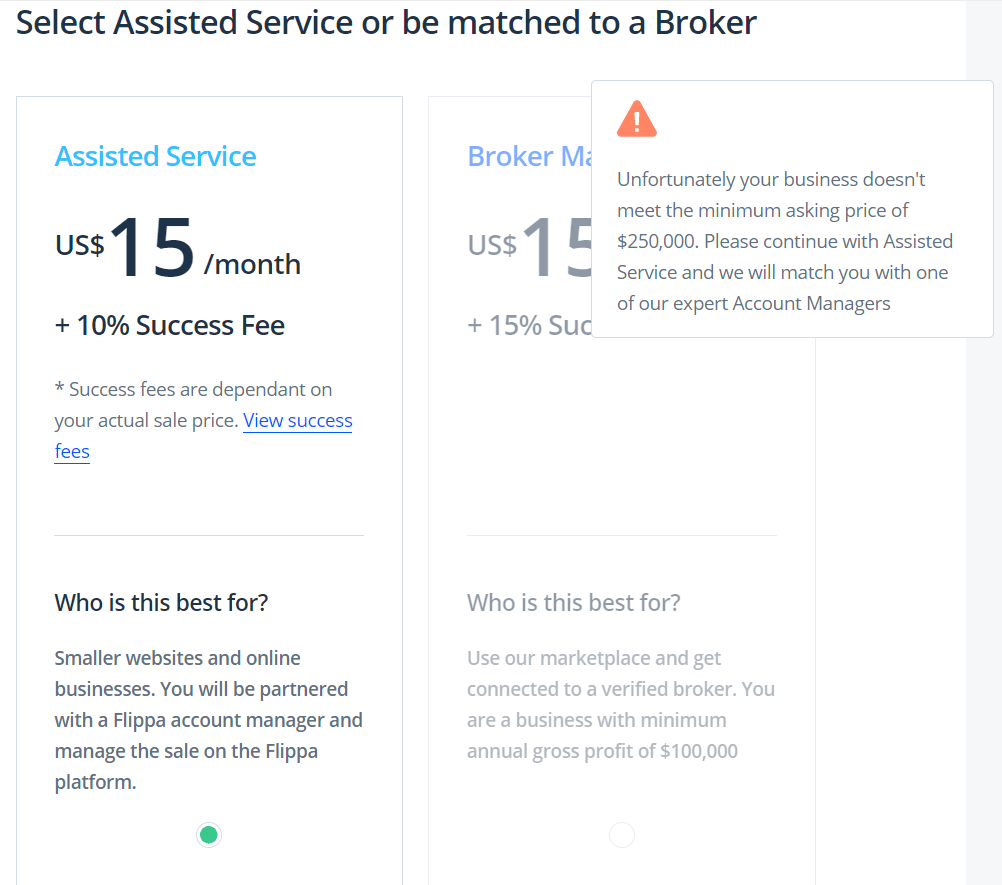

I understand that sellers pay broker fees on a traditional brokerage. It's often a flat fee followed by a percentage of the total sale. Flippa has 2 options for selling your site: Assisted Sale and Broker Management.

Assisted Sale is where you get an account manager. Broker Management is where you get a dedicated broker who finds a buyer for your site. The Broker Management requires a minimum sale price of $250,000.

But here's what's weird: the “flat fee” is a monthly subscription service.

Flippa has low listing fees, so $15/month makes it super simple to decide whether or not to sell your site. Obviously, you can stop the monthly subscription as soon as your site is sold.

Once you select Assisted or Managed, you can choose to boost your listing. You pay your listing fee, boost if you desire, and your property is ready to be sold.

Flippa Price

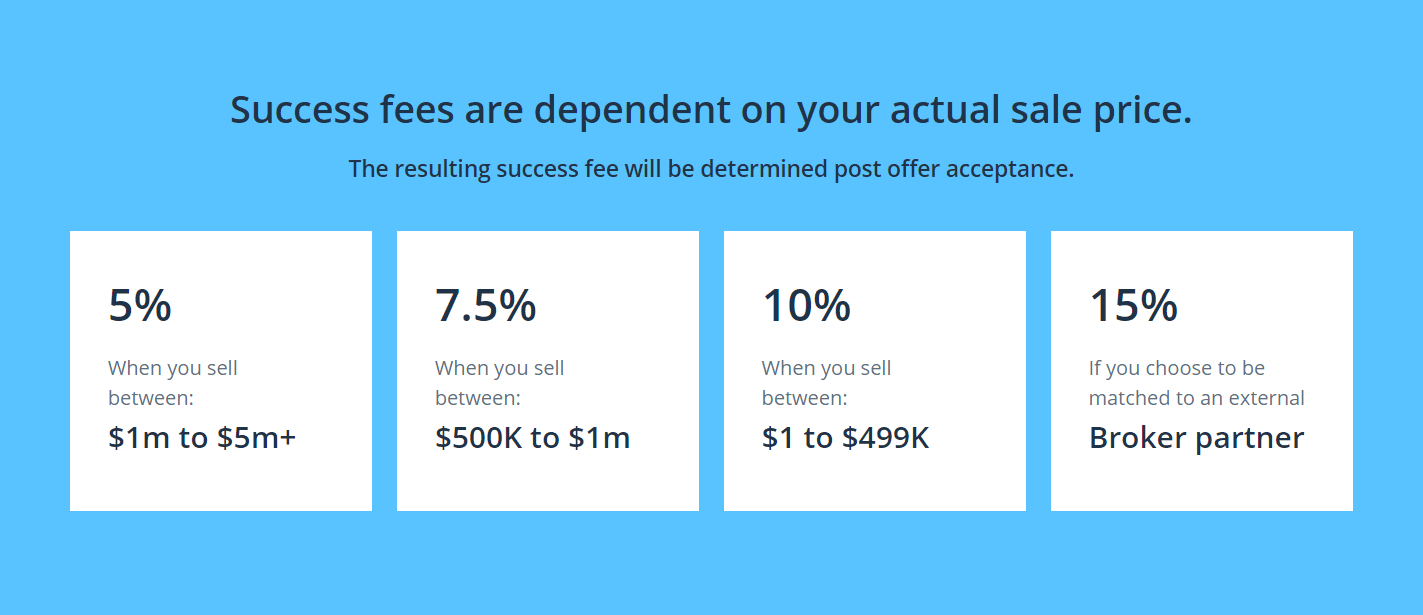

Outside of Flippa's fee of $15/month, they take a success fee as well. As you sell larger web properties, the price decreases:

Most sellers will pay the 10% success fee.

10% plus $15/month is a low price to pay for selling your site.

As much as I love Empire Flippers, (check out Spencer's interview with the founders Joe and Justin) their success fees start at $297 flat fee and then a 15% success fee. Empire Flippers' lowest success fee is still 8%, which is pretty big in comparison to Flippa.

One alternative that bears mention is a business that Spencer started called Motion Invest. The team at Motion Invest actually buys sites and then only sells sites it owns. If you sell your site to Motion Invest, they don't take any sort of broker fees.

Even if your site is pretty small, that savings could be several hundreds or thousands of dollars. You can click here to see what Motion Invest would buy your site for.

Now that we've looked at selling on Flippa, let's check out how it is to be a buyer.

Flippa Review: Buying On Flippa

The math works: buying is often better than building. The failure rate is lower, you're buying an immediate return on investment, and you have an established audience that you can monetize.

But Flippa doesn't have the best reputation for the quality of sites they have listed, so you might need to do some digging to find a good one.

The low quality sites are no doubt a result of Flippa's “0 verification policy” that we looked at above. Anyone can list anything on Flippa and perhaps inflate their numbers.

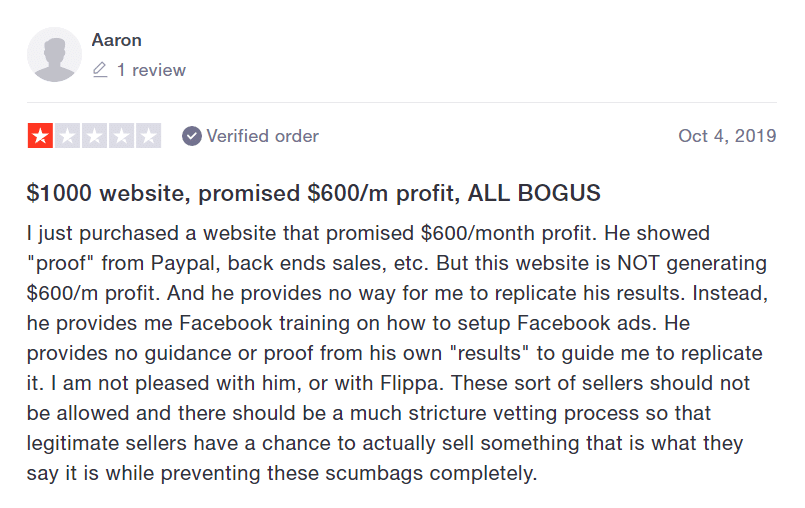

Here's what Aaron over at Trustpilot had to say about his recent Flippa purchase:

Let me start off by saying that this is not completely Flippa's fault. Aaron saw a site “making $600/m profit” and thought he could buy it for $1,000.

Buying a site for less than 2x monthly earnings is probably too good to be true. Unfortunately, for Aaron, it wasn't true.

But this does point out the major flaw with Flippa: No deals are verified. You have to do your own due diligence. And there's a lot of crap that you're going to have to sift through to find the true gems.

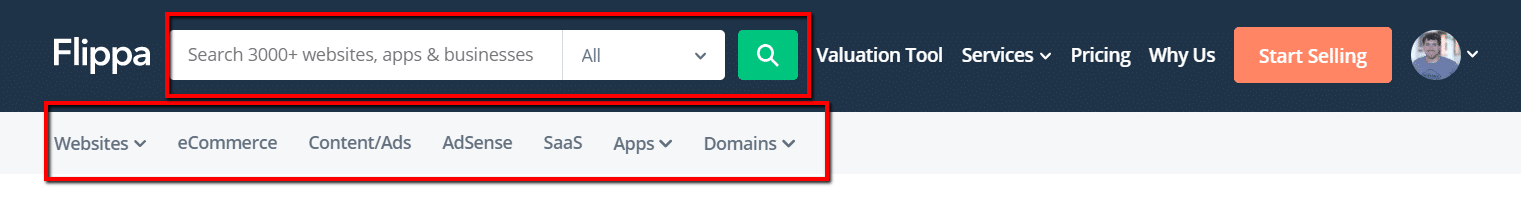

When you do want to buy something from Flippa, you can do it right from the home page. Search the header for any business types you're looking for or use the search bar:

I clicked Websites on the header and then Established Sites. Flippa's established sites are a good starting point if you're looking to buy a website that generates an income. A starter site is more of a template and it can be pretty easy to find scams there.

One thing I do like about Flippa is that they offer a ton of filtering options on the left sidebar. I specified that I wanted a content website (a blog or review site) earning at least $50 per month but less than $500 per month.

Now it's time to start sifting through the results.

There's a very important note to remember here that will make your buying process much easier:

Websites sell for 20x-36x their average monthly profit on a typical brokerage.

This fact alone can help you weed out some of the scammier sites.

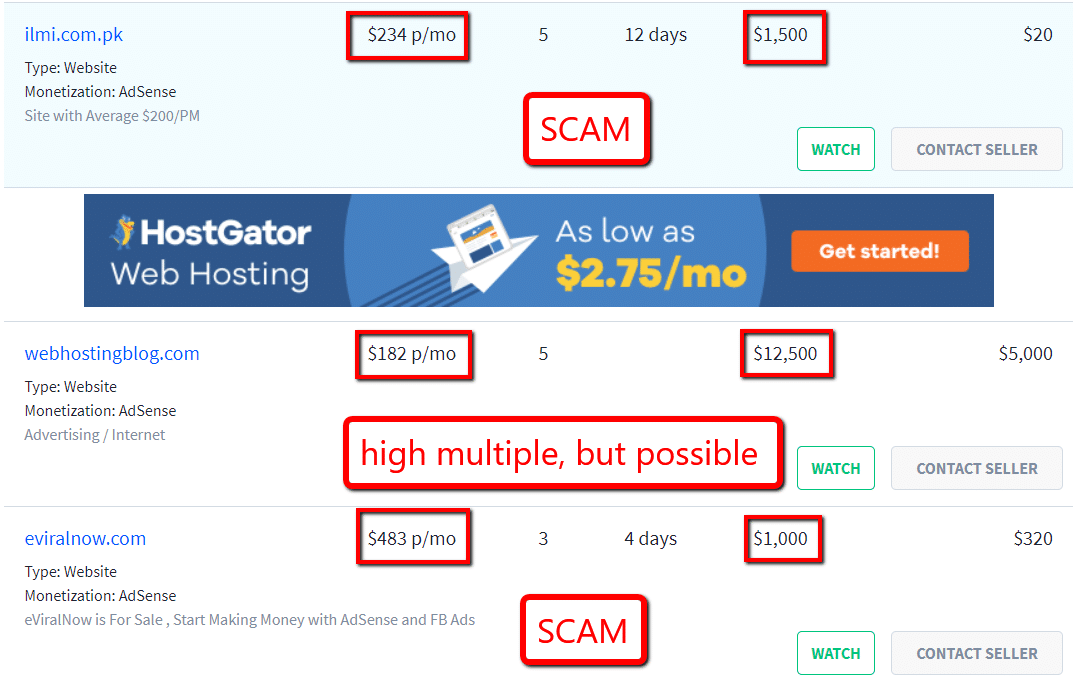

Here are some of the top listings I got for my search. I highlighted the earnings per month, the Buy It Now price, and then marked them as a scam or not:

Let's take a look at these:

- ilmi.com.pk: This site is making $234 per month and is selling for $1,500. That represents a whopping 187% return on investment per year! That site is being sold at a 6x multiple. SCAM

- WebHostingBlog.com: This site is making $182 per month and is being sold for $12,500 on the Buy It Now price. That's pretty high – a multiple of about 70x. But it looks like the auction price might come in quite a bit lower than that. I'd bet that this is a legit business.

- eviralnow.com: This website is making $483 per month and you could buy it for one easy payment of $1,000. You'd even make all your money back and more in just 3 little months. I bet that this owner has a sob story about his kid or says that he's “working on another project”. Wanna say it with me? SCAM

If it's too good to be true, it probably isn't true. And just because you see a lot of bids in the auction doesn't mean that a listing is valuable. It could just mean that there are a bunch of suckers in the world who want the easy way.

Don't be one of them.

You can tell that the one possible website with real value (WebHostingBlog.com) has a pretty high Buy It Now price. That's pretty normal.

I bet that you could do some digging and find a reasonable website with a reasonable Buy It Now (BIN) price. But buyers are motivated to set the BIN high and let the auction drift towards that number. I wouldn't be afraid to look at sites with a high BIN for some more details.

So let's take a look at WebHostingBlog.com and see if it's a viable business.

How To Buy A Good Business On Flippa

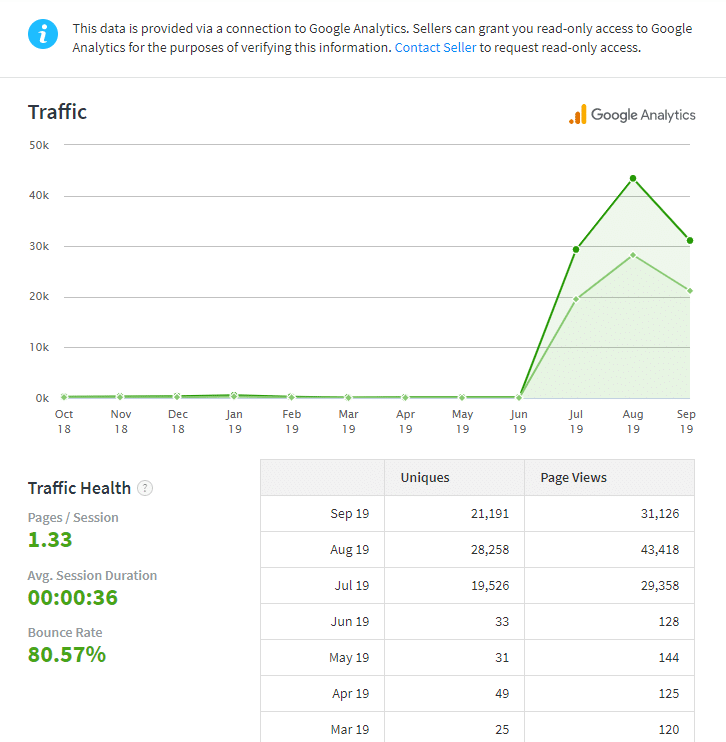

Flippa includes some information that might be helpful to you. They pull reports from Google Analytics and show that on the sale page. You can also see earnings over the past 12 months and the seller's answer to the questions that we looked at during the sale process.

Here's a snippet of what that will look like:

I can't emphasize this enough: if you are a serious buyer, you should request read-only access to Google Analytics. If the seller says no, I would probably walk away. If any of the numbers don't match, that's a big red flag.

There are so many listings on Flippa that you should not be afraid to say no. Be liberal with your rejects and narrow the field as much as you can. It's better to be safe than sorry when we're talking about 4+ figure purchases.

You don't want to end up with a domain name, a starter site, and $0 in earnings due to getting scammed.

Request read-only access and verify all the Google Analytics numbers you see. It's not worth risking.

One thing that scares me here is the massive traffic jump from June to July. In June, this site had 33 unique visitors. July, it at 19,526 unique visitors.

That type of growth is unheard of.

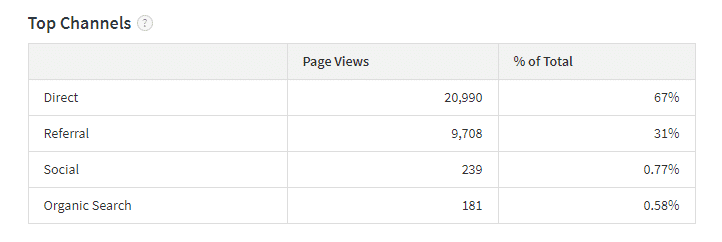

And to make matters worse, it's not coming from a traffic source that we can verify. A huge portion of this site's traffic is direct traffic:

The huge portion of direct and referral traffic makes me nervous. It's not from search engines, it's not from social media… so where's it coming from?

At this point, my assumption would be that the owner here is buying traffic to boost his numbers. I'd leave this site and keep searching.

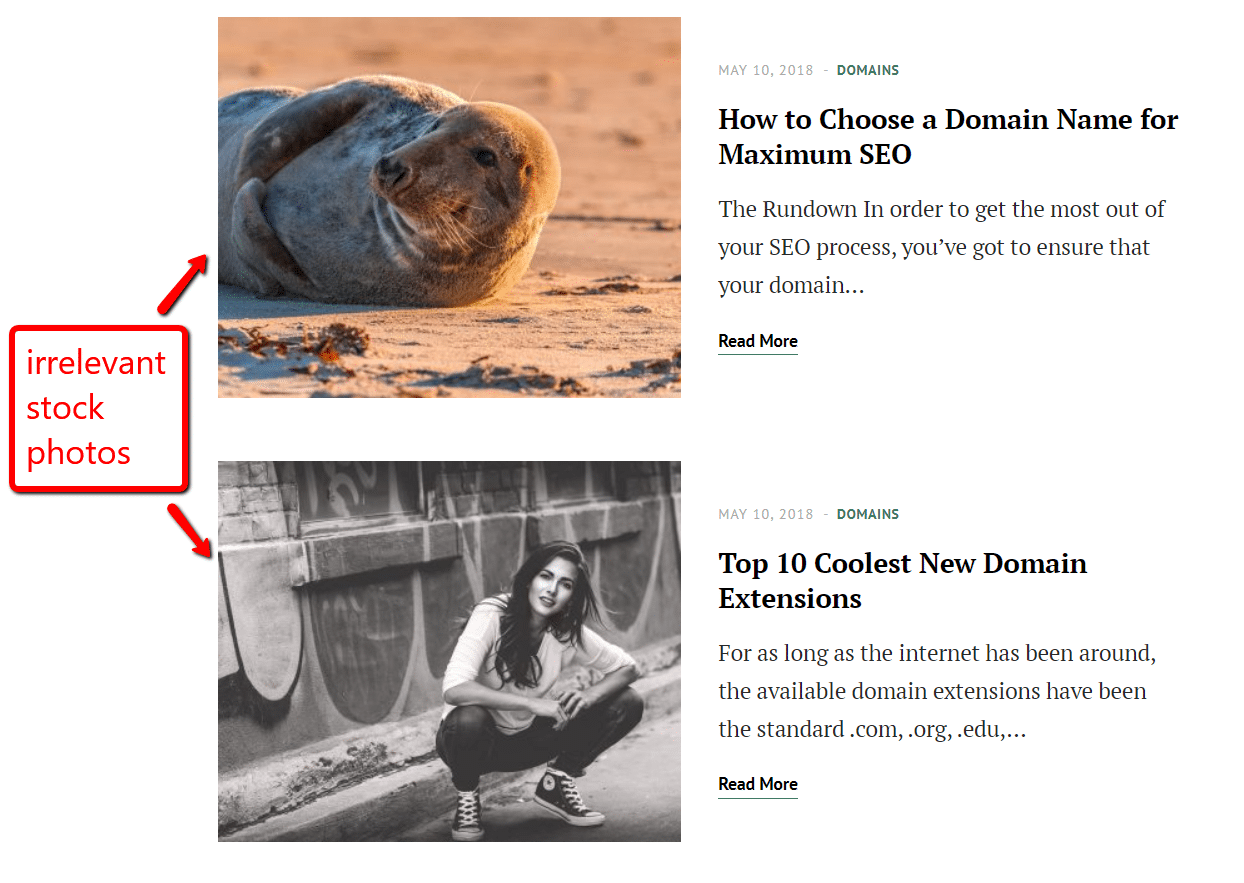

But I'll give you some more reasons why I wouldn't acquire this site. Let's take a look at the site itself:

2 ads above the fold on the home page? Gross. The site was last updated in August and the content is pretty stinking thin.

And then this is silly, but it throws up a red flag for me: the posts don't have relevant featured images.

The more I look at the site, the more I feel like it was just shambled together. Bad featured images, ads on the front page, thin content. These are not good signs.

I'm not liking what I'm seeing here.

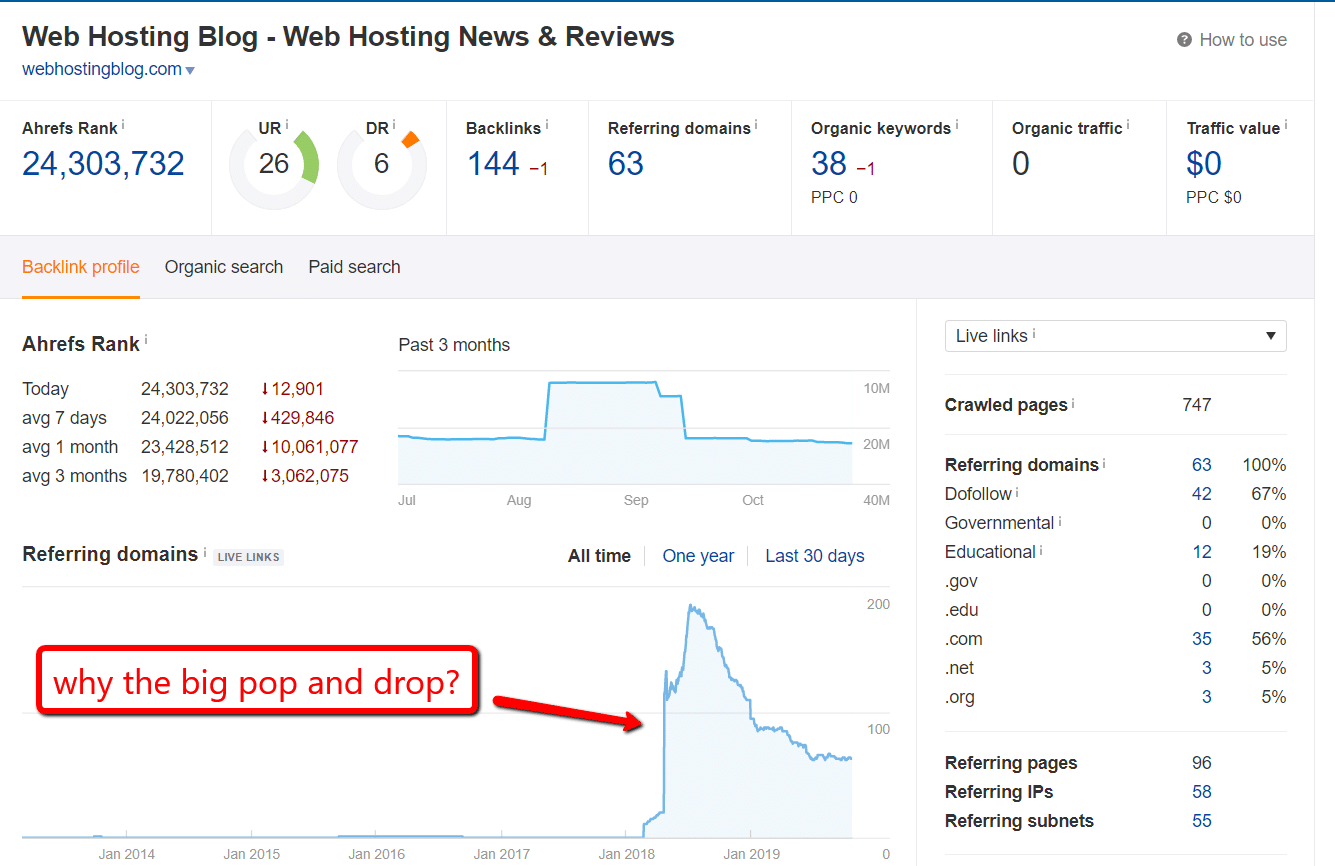

And to put the nail in the coffin, let's do a bit more research: I want to pop this bad boy into Ahrefs (check out my Ahrefs review). Here I'm looking for backlinks. What's the backlink history of the site?

What we find is a little… weird.

The site got a ton of backlinks overnight… and then lost over half of them. I don't know what that means, but I don't know of any link building that could bring in so many backlinks so fast. And some links do drop over time, but this site lost ~60% of their links within a year.

Maybe PBNs? Maybe spammy link building? I don't know, but I don't like it.

And when you look at the referring domains, a lot of them are just strange. Misspellings, websites in multiple different languages. It doesn't strike me as natural linking, but it could be a PBN.

I'd avoid this site.

Here are the steps I would take to do my due diligence and make sure that I wasn't buying a turkey:

- Filter out all results that are too good to be true

- Check and verify all traffic sources. Request read-only access to Google Analytics. Be on the lookout for high amounts of unverifiable Direct traffic (or Social traffic when there are no social media profiles associated with the business). In general, don't trust traffic that you can't verify.

- Spend some time looking at the site. Trust your gut. If it feels “off” or “weird”, then leave it. There are tons of other options

- Check the site's backlink profile. Look for steep inclines or declines as these could be bad signs. If you'd consider many of the backlinking sites a “risky click”, then that should start throwing up some red flags

How To Avoid Scams On Flippa

The more I look at Flippa, the more amazed I am: there are tons of blatant scams on the site that are selling like hot cakes. People are bidding on and buying these sites in droves. It's even worse than when I bought a (legit) Flippa business a few years ago.

This problem wouldn't be as big of a deal if Flippa took the time to verify the businesses listings that go up on the site. (That's why Spencer opened a marketplace for small, verified sites at Motion Invest where all the sites are legit and verified).

And one pro tip before we get into scam-avoidance: I have the best luck finding legit sites when I place the site earnings between $1 and $500 per month. I don't know what it is about this range that works well, but I saw several sites that looked legitimate.

So here are a few principles to avoid scams on Flippa:

Don't Believe Anything Too Good To Be True

The number one rule that will save you a lot of hassle is that if something is too good to be true, safe to say that it's not true.

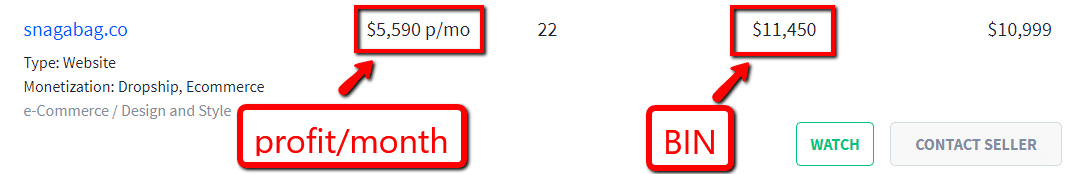

A quick way to make this judgment is to divide the BIN price by the average monthly income. If you get a number below 25, I'd say to go ahead and pass on that site.

Here's an example:

This one is pretty obvious, but it gets my point across. The Buy It Now price is $11,450. The profit per month is $5,590. If that doesn't scream scam, I don't know what does.

I'd be wary of anything where the BIN price is less than 25x the monthly profit.

Get Nervous About Unverifiable Traffic

I like for my websites to have organic traffic. Social is a good 2nd option, but organic is my favorite. I like these two because I can verify where the traffic comes from.

I can verify organic traffic and paid traffic using Google Analytics and Ahrefs to check rankings. Then I can verify social traffic by looking at Google Analytics and then checking social channels.

But direct traffic? There aren't many people who go straight to a website by typing in the URL. (and yeah, I know that direct traffic can be other things. But it shouldn't be and is impossible to fact check).

I can't do anything with direct traffic. It can't be verified. The one exception to this would be email marketing. If the site claims to have a large email list, I would want a video walkthrough showing the list and verifying that it's for the site listed.

Organic, social, or paid traffic are all fine. Direct traffic makes me nervous.

Avoid “Weird” Sites

I always recommend taking a dive into the site that you're looking at buying. You want to check that all the main level links in the headers and footers are functional. Check how good the posts are, the site layout.

If anything looks “weird” and you get an odd feeling, I say trust your gut. Scammers thrive on creating things that look good at first glance but are ugly on the inside. A few click levels deep is where you'll find the site's ugliest beasts, so be willing to trust yourself if you're seeing something you don't like.

One “weird” thing for me with the site we looked at earlier was that the featured images had no relation to the posts themselves. A post would be about hosting options and would have pictures of otters.

I'm all for some otters holding hands. But that's not relevant to the post itself. Just little stuff like that can throw up a red flag so keep your eyes open.

Who Is Flippa Best For?

Flippa has a lot of scams on it, but it does fill its own niche. If you're buying a site and have six figures to spend, I'd tell you to start at Empire Flippers and go to Quiet Light Brokerage if you're looking for bigger price tags still.

But if you aren't buying or selling for some pretty high numbers, where does that leave you?

I think that Flippa is fine to sell your site on. You have to pay a subscription and a success fee structure and you'll need to remember to cancel the $15 per month subscription. But Flippa has buyers; lots and lots of buyers.

Sellers will need to get ready to deal with tire kickers. Anyone can message you on Flippa. Anyone can comment on your site listing and trash you or bring up invalid concerns (this happens a lot on Flippa). You'll be asked to verify and lead people through the same metrics again and again.

You might be paying less, but you will be working more. Selling your site will be more labor intensive than with other, more expensive brokers. (Unfortunately, higher end brokers aren't really interested in talking to you unless your site is usually making a few thousand dollars a month or more).

And I have a hard time recommending Flippa to buyers. There are just too many scams on the platform for me to feel comfortable saying that you should use it. Buying on Flippa will take forever. You'll always be filtering results and getting verification. Then there's still a good chance that some dummy will buy the site out from under you.

If my mom wanted to buy a site on Flippa, I'd tell her to do 1 of 2 things:

- Save your money for a broker like Empire Flippers or FEInternational

- Or go to MotionInvest where they sell inexpensive sites that have already been verified

Flippa doesn't pass the “mom test” and because of that, I don't feel comfortable recommending it to other buyers.

Building Your Website Empire

Also, here's a great article is you are looking for Flippa alternatives.

Flippa is a fine place to sell your businesses, but I wouldn't recommend buying on Flippa unless you are very experienced. You will have to filter out listings (there are tons), verify all sorts of stuff, and have an excellent knowledge of what it takes to be successful in internet marketing.

If your site is big or you have a 5+ figure budget, I recommend Empire Flippers.

If you want to sell your site without broker fees or buy a site that has verified earnings, traffic, and a healthy backlink profile, then I would recommend MotionInvest. MotionInvest is Spencer's own business (shameless plug) but they verify every site that sells on the platform and they're willing to buy income-generating sites.

So the final verdict on this Flippa review?

Despite the fact that there could be good deals to be found if you are an advanced buyer, I have trouble recommending Flippa in general.

Want to learn step-by-step how I built my Niche Site Empire up to a full-time income?

Yes! I Love to Learn

Learn How I Built My Niche Site Empire to a Full-time Income

- How to Pick the Right Keywords at the START, and avoid the losers

- How to Scale and Outsource 90% of the Work, Allowing Your Empire to GROW Without You

- How to Build a Site That Gets REAL TRAFFIC FROM GOOGLE (every. single. day.)

- Subscribe to the Niche Pursuits Newsletter delivered with value 3X per week

My top recommendations

4 Comments

Conversation

Hi Brady,

thanks for the review! Great stuff.

I was wondering – flippa and empire flippers list valuations on the multiple of average monthly profit.

However in one of the preivous articles (https://www.nichepursuits.com/niche-site-project-4-july-2019/), Spencer mentions valuation on topline/revenue. Why is it so? What am I missing?

Thanks!

Valuations are always done on net profit. I think you may have misinterpreted my previous post.

At the start of Flippa the site was good. They had good buyers and sellers but they got greedy and too big… Flippa is done.

Hey Nomar, tbh I agree. It’s pretty tough to find a solid deal unless you have a budget. At which point, it’s easier to go to other brokers to buy.